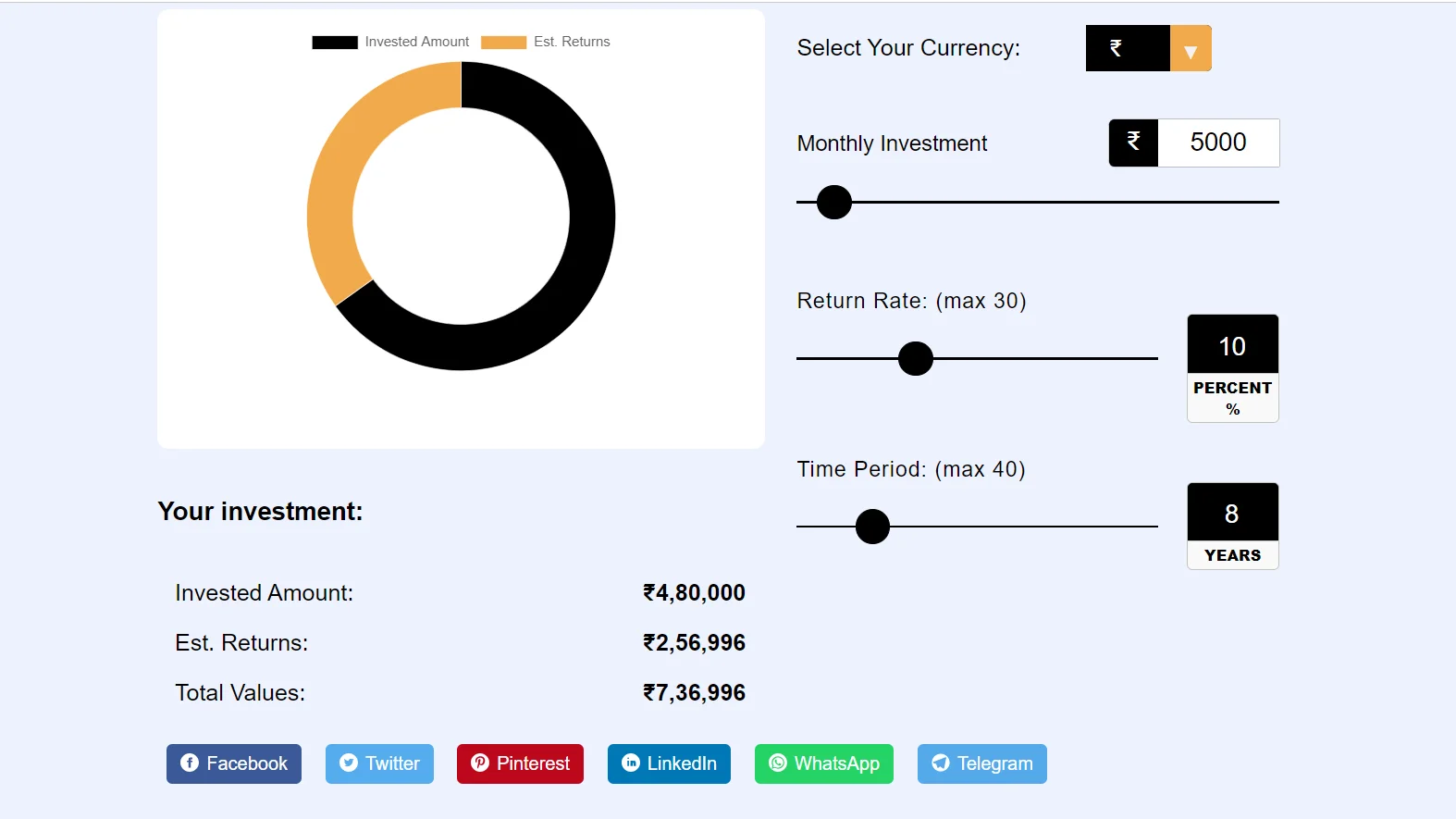

Invested Amount:

Est. Returns:

Total Values:

Planning your investments can seem complicated for many. But with the help of a SIP calculator, you can easily estimate returns and align your SIPs to achieve financial goals. With the help of this tool, you can easily calculate SIP.

Sip Calculator tool is easy to use and this tool is absolutely free.

SIP or Systematic Investment Plan allows you to invest a fixed amount regularly in mutual funds, usually monthly. It helps in disciplined investing and maximizing wealth creation through the power of compounding.

SIP is an investment plan in which you invest your small amount. And from these small amount of yours that you will get the return, You can calculate the returns with our SIP calculator.

Sip Calculator is a calculator tool created by us with the help of which you can calculate Systematic Investment Plan. That too absolutely free, you just have to visit our website sip-calculators.com and you can calculate your SIP.

Our SIP calculator is very easy to use. Which I have explained below to use.

Step 1. To calculate SIP, you have to visit our free SIP calculator website Sip-Calculators.Com.

Step 2. After coming to the website, you have to select your own currency. (This is optional.)

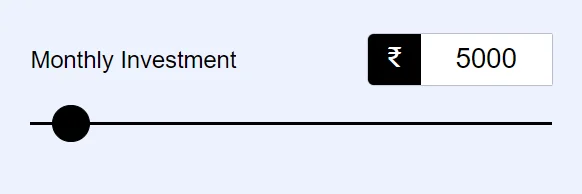

Step 3. You have to select how much money you will invest every month.

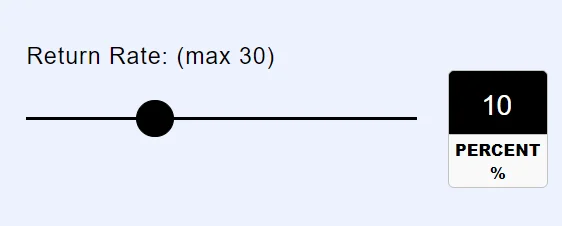

Step 4. How much percent return will you get? have to select it.

Step 5. Select the years for which you will invest.

Step 6 In the next step, whatever return you will get in SIP, you will be told.

If you invest in sip then you should know about the benefits of SIP. There are many advantages of investing in SIP which are as follows.

There are also some disadvantages of SIP which are given below.

| The formula used by our SIP Calculator is M = P × ({[1 + i]^n – 1} / i) × (1 + i). |

|---|

| M = is the amount you receive upon maturity.. |

| P = is the amount you invest at regular intervals. |

| n = is the number of payments you have made. |

| i = is the periodic rate of interest. |

Example:

You're making an investment of $1,000 each month for a year at an interest rate of 12%.

The monthly rate of return would be 12%/12 = 1/100 = 0.01

Consequently, you will receive around 12,809 in a year.

However, keep in mind that the interest rate on mutual funds varies depending on the state of the market. It might go up or down, which would affect the projected returns.

Note : Please suggest new features or report any error, to help us improve this website.