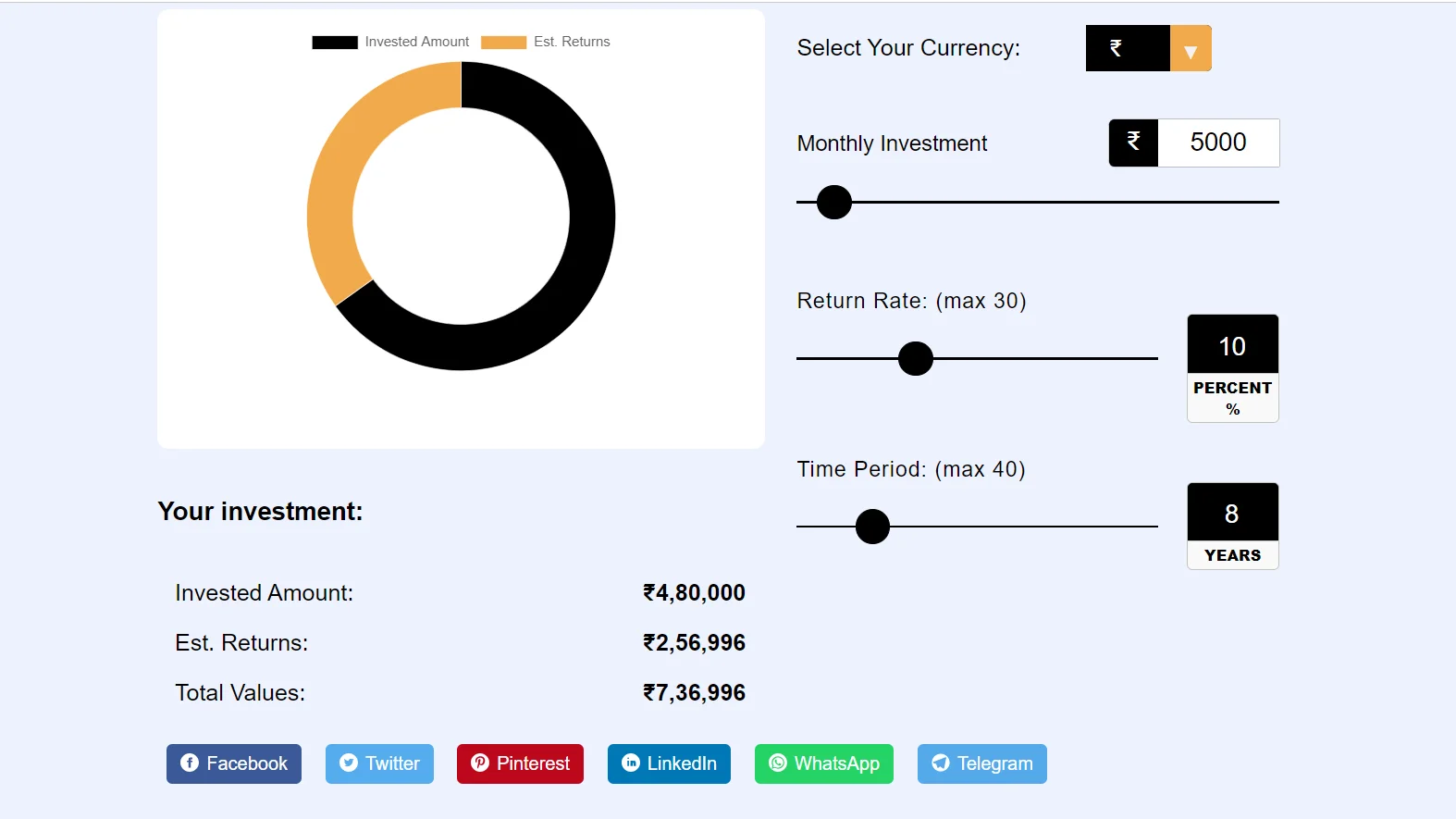

Invested Amount:

Est. Returns:

Total Values:

Easy-to-use Axis Bank SIP calculator to help you plan your investments in mutual funds. The Axis Bank SIP calculator online tool is free to use and very handy for planning your mutual fund investments. It takes the guesswork out of SIP planning!

Sip Calculator tool is easy to use and this tool is absolutely free.

SIP is an investment plan in which you can start with as little as Rs.500. With the help of this Axis Bank SIP calculator tool, you can easily calculate SIP returns. That too absolutely free of cost. SIP is also known as Systematic Investment Plan.

A SIP (Systematic Investment Plan) calculator is a tool that helps investors determine the returns they can expect to earn by investing a fixed amount of money at regular intervals (such as monthly or quarterly) in a mutual fund or another investment vehicle.

Here are some benefits of using Axis Bank's SIP Investment Calculator:

The calculator has a simple interface and the investment projection is generated with just a few input details.

The calculator allows entering both lumpsum and monthly SIP investments to see combined investment growth.

You can adjust SIP amount, investment tenure, expected returns etc. and see the change in maturity amount. This allows scenario planning.

Calculating potential returns manually can be time-consuming and prone to errors. SIP calculators automate the calculation process, saving you time

| The formula used by our SIP Calculator is M = P × ({[1 + i]^n – 1} / i) × (1 + i). |

|---|

| M = is the amount you receive upon maturity.. |

| P = is the amount you invest at regular intervals. |

| n = is the number of payments you have made. |

| i = is the periodic rate of interest. |

Example:

You're making an investment of $2,000 each month for a year at an interest rate of 12%.

The monthly rate of return would be 12%/12 = 1/100 = 0.01

Consequently, you will receive around 25,619 in a year.

Please note that mutual fund returns can vary and are subject to market fluctuations. The actual returns may differ from your expected rate of return.

Our Axis Bank SIP calculator is very easy to use. Which I have explained below to use.

Step 1. To calculate SIP, you have to visit our free Axis Bank SIP calculator website Sip-Calculators.Com.

Step 2. After coming to the website, you have to select your own currency.

Step 3. You have to select how much money you will invest every month.

Step 4. How much percent return will you get? have to select it.

Step 5. Select the years for which you will invest.

Step 6 In the next step, whatever return you will get in SIP, you will be told.

Note : Please suggest new features or report any error, to help us improve this website.