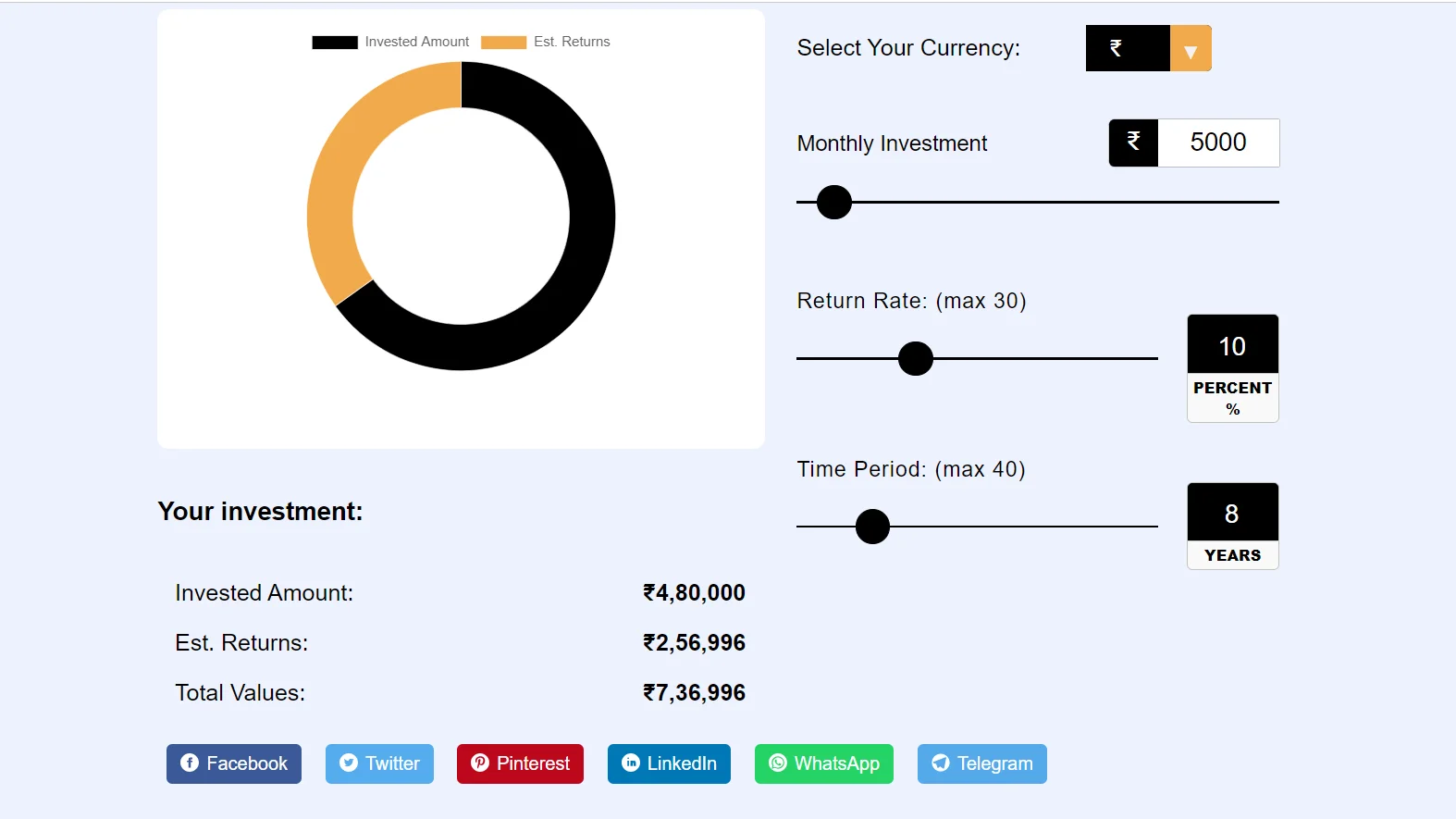

Invested Amount:

Est. Returns:

Total Values:

Kotak Mahindra Bank SIP Calculator is online tool. With the help of which you can calculate the return of Systematic Investment Plan. And we have provided this tool absolutely free of cost for you.

This Kotak Mahindra Bank Sip Calculator tool is easy to use and this tool is absolutely free.

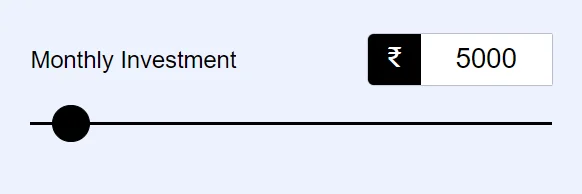

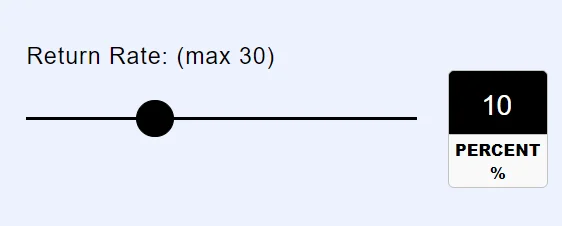

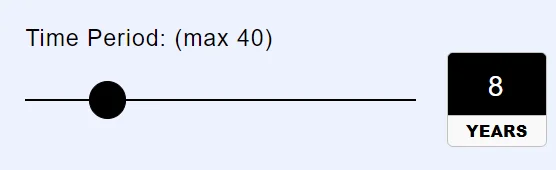

Kotak Mahindra Bank SIP calculator online tool, you need to enter your total investment amount, your investment Time Period, and the expected rate of return per annum. Once you finish inputting these, the SIP return calculator, calculates the return and gives you value at maturity.

SIP calculator is a simple tool that can be used to calculate the maturity value of an investment made through a SIP (Systematic Investment Plan) in a mutual fund.

A SIP (Systematic Investment Plan) calculator is a tool that helps investors calculate the expected returns on their investments made through SIPs. Systematic investment plan is a method of investing a fixed amount of money at regular intervals (usually monthly) into a mutual fund or another investment.

The Kotak SIP Calculator offers several benefits to investors. Here are some benefits of using Sip Calculator:

The tool also eliminates the tedious calculation of manually calculating the maturity value. This tool reduces the difficult calculation of SIP in a few seconds.

Kotak Mahindra Bank SIP calculator has such a simple interface that even a child can use it.

This calculator is free. Anyone can use it anywhere, that too for free. Investors can use the calculator unlimited times at no charge.

The calculator is very easy to use, it can be used by any small child.

With the help of calculator, you can calculate the return you will get in SIP. This will save you time, you can spend this time elsewhere and get good results. Therefore, any investor can check the scheme's potential returns at their fingertips.

| The formula is FV/M = P × ({[1 + i]^n – 1} / i) × (1 + i). |

|---|

| FV/M = Future Value |

| P = is the amount you invest at regular intervals. |

| n = is the number of payments you have made. |

| i = is the periodic rate of interest. |

Example:

Mr. JK invests Rs. ₹60,00 every month in his Kotak SIP scheme for a tenure of 1 year at a 12% interest rate. His Future estimated maturity return value will be:

Future Value = ₹60,00 ({[1 + 0.01] ^ {12 – 1} / 0.01) x (1 + 0.01)

Future Value = ₹7,68,560 yearly (approximately)

So based on the inputs, the Kotak SIP Calculator projects a future value of ₹7,68,560 at a 12% expected return on a ₹48,560 monthly SIP for 1 years.

Kotak Mahindra Bank SIP calculator is very easy to use. Which I have explained below to use.

#Step 1. Go to Sip-Calculators.Com website and access the Kotak SIP calculator.

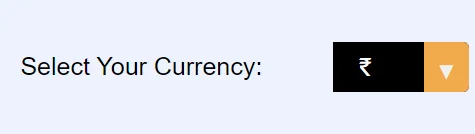

#Step 2. After coming to the website, you have to select your own currency.

#Step 3. Enter the monthly SIP amount you want to invest.

#Step 4. Enter expected annual returns in percentage.

#Step 5. Input the time period in years.

#Step 6 In the next step, whatever return you will get in SIP, you will be told.

Hope you liked our Kotak Mahindra Bank SIP Calculator. If you liked it then share it with your friends. And will definitely keep this tool bookmarked. So that if you read the need of the tool later, then you can easily reach this tool.

Note : Please suggest new features or report any error, to help us improve this website.