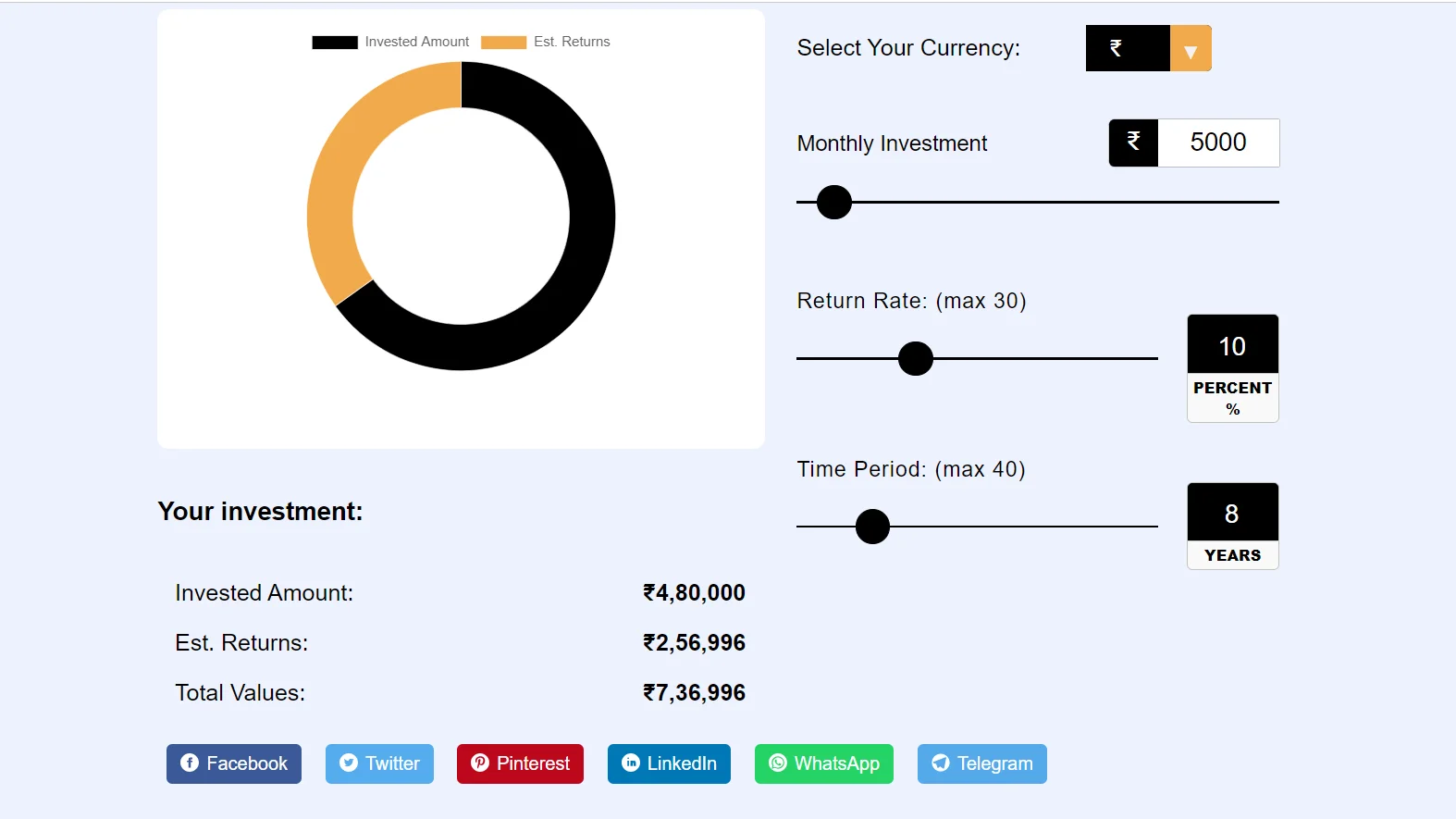

Invested Amount:

Est. Returns:

Total Values:

SIP (Systematic Investment Plan) is a method of investing a fixed amount regularly into a mutual fund scheme. SBI Bank SIP Calculator is an online tool. And we have provided this tool absolutely free of cost for you.

This State Bank of India Sip Calculator tool is easy to use and this tool is absolutely free.

SBI SIP Calculator is a tool used to estimate the returns on a systematic investment plan (SIP) with the State Bank of India (SBI). The systematic investment plan, or SIP, is a method for periodically investing a certain amount of money in mutual funds.

A SIP is a popular investment method in which you regularly invest a fixed amount of money at predetermined intervals (e.g., monthly) in a mutual fund. State Bank of India SIP Calculator is a useful tool for anyone looking to start investing in SIP offered by the bank.

A Systematic Investment Plan (SIP) is a popular method of investing in mutual funds. It allows investors to contribute a fixed amount regularly to purchase units of a mutual fund scheme.

Using an SIP calculator provides several benefits for investors:

| The formula is FV/M = P × ({[1 + i]^n – 1} / i) × (1 + i). |

|---|

| FV/M = Future Value |

| P = Monthly SIP Amount |

| n = is the number of payments you have made. |

| i = is the periodic rate of interest. |

Example:

Mr. JK invests Rs.70,000 every month in his SBI SIP scheme for a tenure of 1 year at a 12% interest rate. His Future estimated maturity return value will be:

Future Value = 70,000 ({[1 + 0.01] ^ {12 – 1} / 0.01) x (1 + 0.01)

Future Value = ₹7,68,560 yearly (approximately)

Therefore, the future value of the SIP after 1 years at 12% expected returns is ₹7,68,560

So based on the inputs, the SIB SIP Calculator projects a future value of ₹7,68,560 at a 12% expected return on a ₹48,560 monthly SIP for 1 years.

State Bank of India SIP calculator is very easy to use. Which I have explained below to use.

#Step 1. Go to Sip-Calculators.Com website and access the SIP calculator.

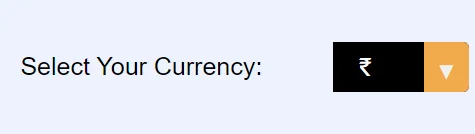

#Step 2. After coming to the website, you have to select your own currency.

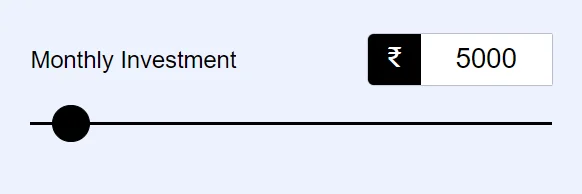

#Step 3. Enter the monthly SIP amount you want to invest.

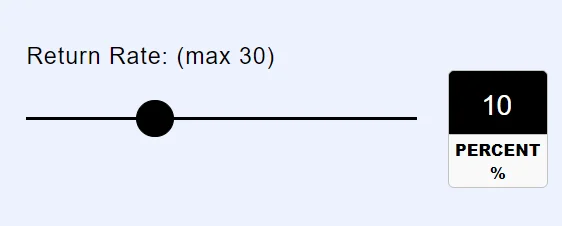

#Step 4. Enter expected annual returns in percentage.

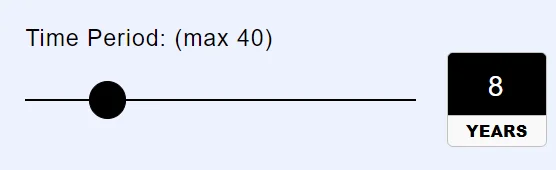

#Step 5. Input the time period in years.

#Step 6 In the next step, whatever return you will get in SIP, you will be told.

I hope you liked our SBI Bank SIP Calculator. If you liked it then share it with your friends. And will definitely keep this tool bookmarked. And that too can calculate SIp returns without any hassle.

Note : Please suggest new features or report any error, to help us improve this website.