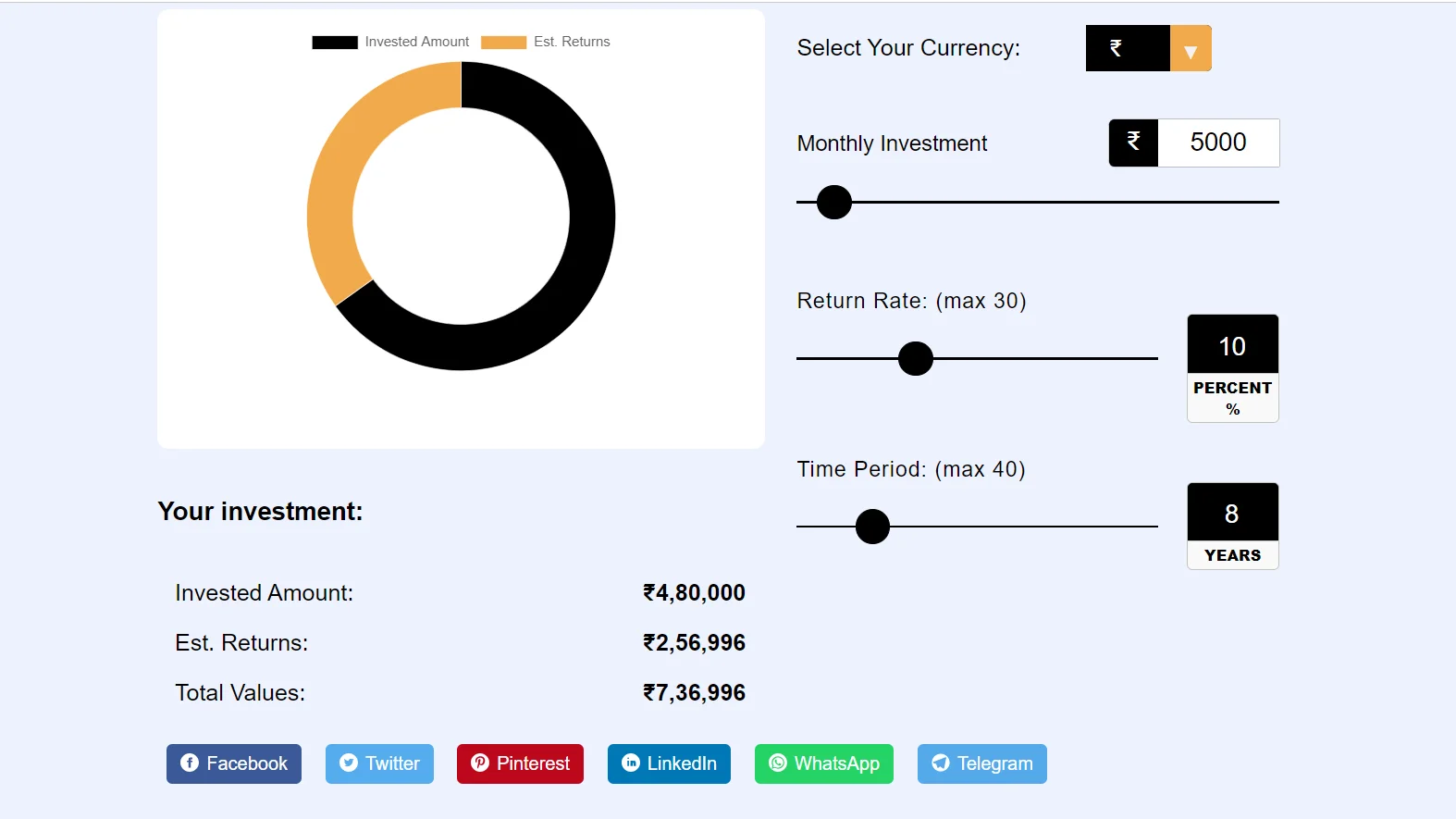

Invested Amount:

Est. Returns:

Total Values:

A Union Bank SIP Calculator is a financial tool. With the help of which you can calculate the return and total values of Systematic Investment Plan. This tool absolutely free of cost for you.

Union Bank of India Sip Calculator tool is easy to use and this tool is absolutely free.

Union Bank sip calculator is a financial online tool. With the help of which you can calculate the return and total value of a Systematic Investment Plan, very easily. So we have created Systematic Investment Plan calculator tool for you which you can use for free.

SIP (Systematic Investment Plan) is an investment option that allows investors to invest a fixed amount of money at regular intervals (such as monthly) into a mutual fund scheme. A SIP Calculator is a tool that helps investors determine the future value of their investments made through the SIP option.

These union SIP calculators allow members to input details like monthly investment amount, expected rate of return, investment tenure etc. to get an estimate of the final corpus they can expect on maturity.

Union Bank's online SIP calculator makes it easy for customers to estimate returns on potential SIP investments. Here are some key benefits of using the Union Bank SIP calculator:

| The formula is FV = P × ({[1 + i]^n – 1} / i) × (1 + i). |

|---|

| FV = Future Value |

| P = is the amount you invest at regular intervals. |

| n = is the number of payments you have made. |

| i = is the periodic rate of interest. |

Example:

Mrs. PR invests Rs. ₹20,000 every month in his Union Bank SIP scheme for a tenure of 1 year at a 12% interest rate. His Future estimated maturity return value will be:

Future Value = ₹20,000 ({[1 + 0.01] ^ {12 – 1} / 0.01) x (1 + 0.01)

Future Value = ₹2,56,187 yearly (approximately)

So based on the inputs, the Union Bank SIP Calculator projects a future value of ₹2,56,187 at a 12% expected return on a ₹16,187 monthly SIP for 1 years.

Here’s how to use the calculator.

#Step 1. Go to Sip-Calculators.Com website and access the Union SIP calculator.

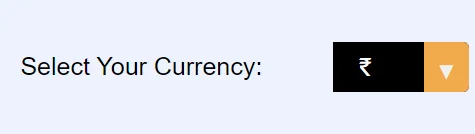

#Step 2. After coming to the website, you have to select your own currency.

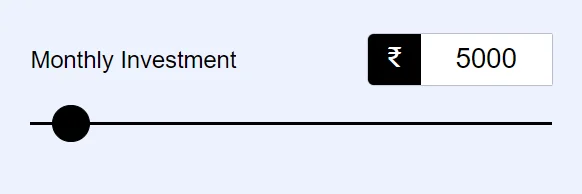

#Step 3. Enter the monthly SIP amount you want to invest.

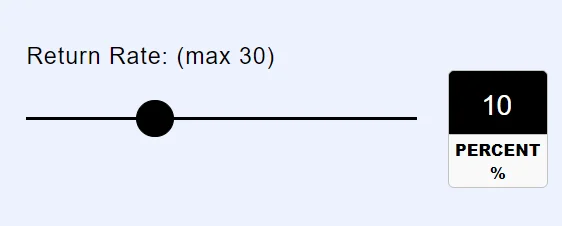

#Step 4. In this step, enter the return rate or move the slider.

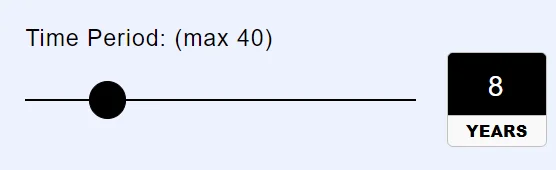

#Step 5. Choose the investment period.

#Step 6 In the next step, whatever return you will get in SIP, you will be told.

It will show the invested amount, estimated returns and the total value. It’s that easy!

SIP calculators are a useful tool for investors as they allow them to see the potential returns on their investments and make informed decisions about how much and how often to invest. I Hope you liked our Union Bank SIP Calculator. If you liked it then share it with your friends.

Note : Please suggest new features or report any error, to help us improve this website.