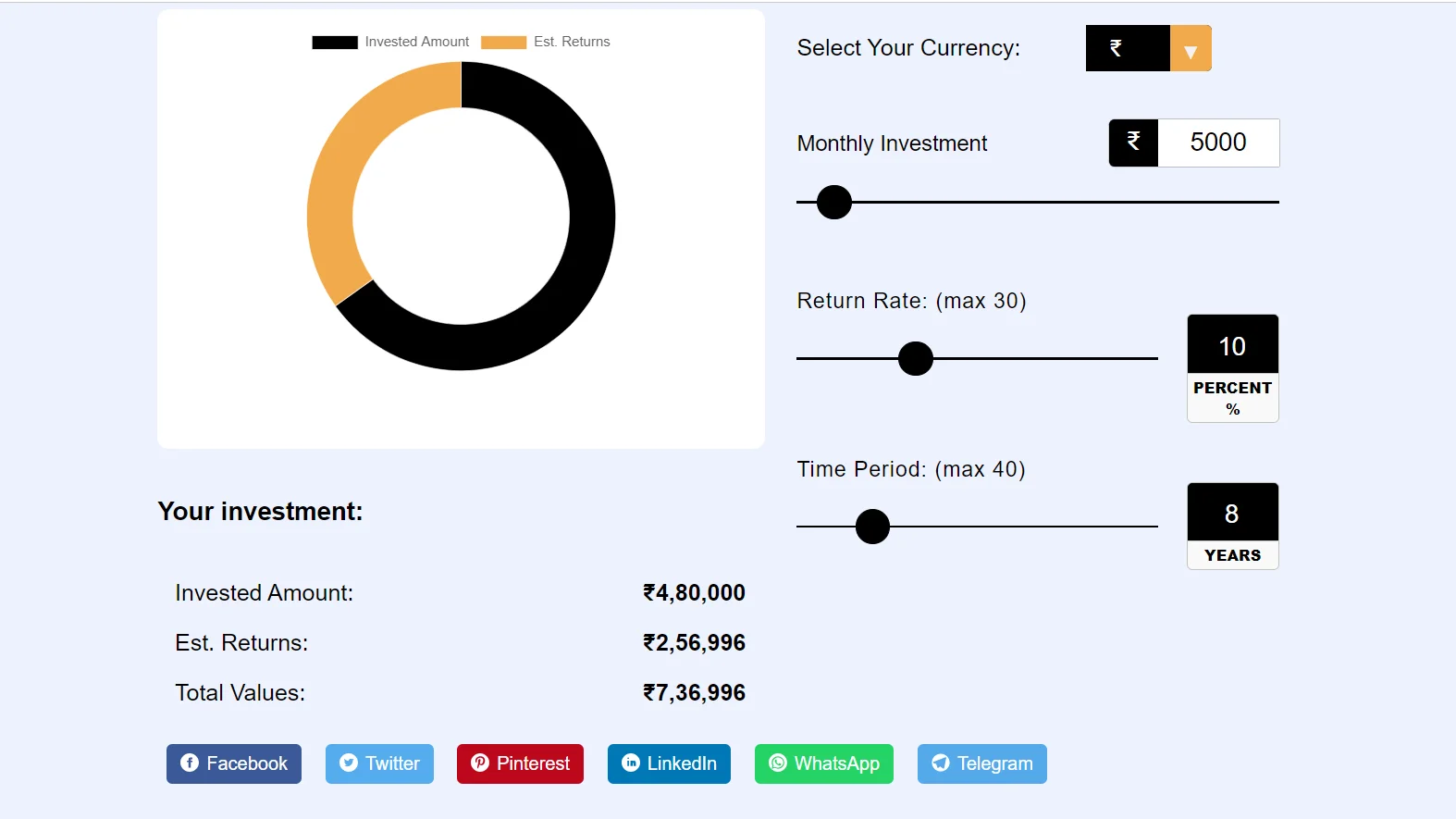

Invested Amount:

Est. Returns:

Total Values:

PNB SIP Calculator is online Systematic Investment Plan calculator tool. With the help of which you can easily calculate Punjab National Bank SIP. That too absolutely free, there is no charge of any kind in it.

This Punjab National Bank Sip Calculator tool is easy to use and this tool is absolutely free.

The PNB SIP Calculator is an online financial tool provided by Punjab National Bank (PNB) and our website. SIP or Systematic Investment Plan allows you to invest a fixed amount regularly each month or quarter in a mutual fund scheme.

SIP calculators are generally available online on the websites of mutual fund companies and financial institutions. The PNB SIP Calculator can be used to determine the projected returns on a regular investment made in the PNB Mutual Fund over a specified period of time. It is a useful tool for investors to plan their investments and set financial goals.

The PNB SIP Calculator offers several benefits to investors. Here are some benefits of using Sip Calculator:

| The formula is M = P × ({[1 + i]^n – 1} / i) × (1 + i). |

|---|

| M = is the amount you receive upon maturity.. |

| P = is the amount you invest at regular intervals. |

| n = is the number of payments you have made. |

| i = is the periodic rate of interest. |

Example:

You're making an investment of ₹35,000 each month for a year at an interest rate of 12%.

The monthly rate of return would be 12%/12 = 1/100 = 0.01

Consequently, you will receive around ₹4,48,326 in a year.

So based on the inputs, the PNB SIP Calculator projects a future value of ₹4,48,326 at a 12% expected return on a ₹35,000 monthly SIP for 1 years.

Our Punjab National Bank SIP calculator is very easy to use. Which I have explained below to use.

#Step 1. Go to Sip-Calculators.Com website and access the SIP calculator.

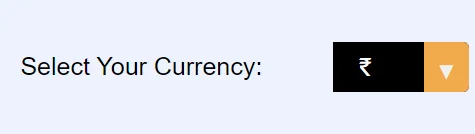

#Step 2. After coming to the website, you have to select your own currency.

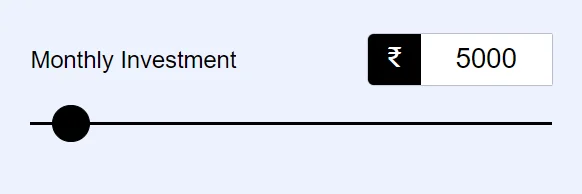

#Step 3. Enter the monthly SIP amount you want to invest.

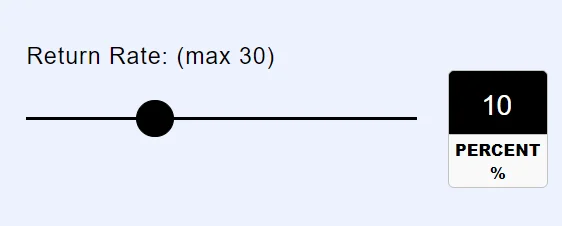

#Step 4. Enter expected annual returns in percentage.

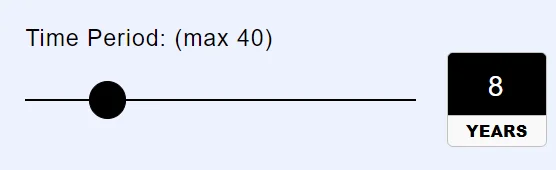

#Step 5. Input the time period in years.

#Step 6 In the next step, whatever return you will get in SIP, you will be told.

You can change the inputs and compare different scenarios to optimize your SIP. The PNB SIP calculator is an excellent tool for retail investors to plan their mutual fund SIPs in a hassle-free way. If you liked this SIP calculator tool, then share it with your friends as well. And that too can calculate SIP returns without any hassle.

Note : Please suggest new features or report any error, to help us improve this website.